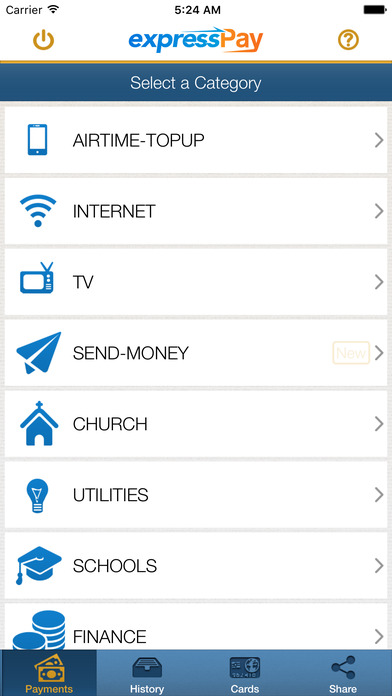

This morning, I checked my phone and noticed that I was low on credit. Normally, I would walk outside my house, go to the nearest vendor, and re-up my phone credit. But instead, I simply used my ExpressPay app, signed in, selected the Airtime menu and just used my VISA card to buy credit.

The whole process took about one minute. The notification came on my phone that I had received credit.

It’s been practically a year and a half and I can’t tell you the last I bought a scratch card. Since I started using the ExpressPay app, I haven’t thought twice about going back. It seems that many other people are joining in and making use of payment apps in the market. Slydepay, ExpressPay, ZeePay, and MPower are slowly becoming household names. The convenience that these apps bring can’t be understated. Using your mobile money or your bank card to make payments has never been easier.

But what about the banks themselves? Apart from using my bank issued VISA and the ATM, I’ve never really felt the need to use them to make payments such as ECG bills or other utilities even though I get regular notifications from my bank that they offer those services?

Banks Have Been Slow To Evolve

The new wave is mobile. All the statistics point to that. If you’re a service provider and you don’t have an online service portal or a mobile app, you’re way behind the times. Nobody wants to go the bank, stand in line and make payments. People have busy schedules and things to do. But it seems that the banks have been slow to realize that and offer customers more convenient ways to do banking.

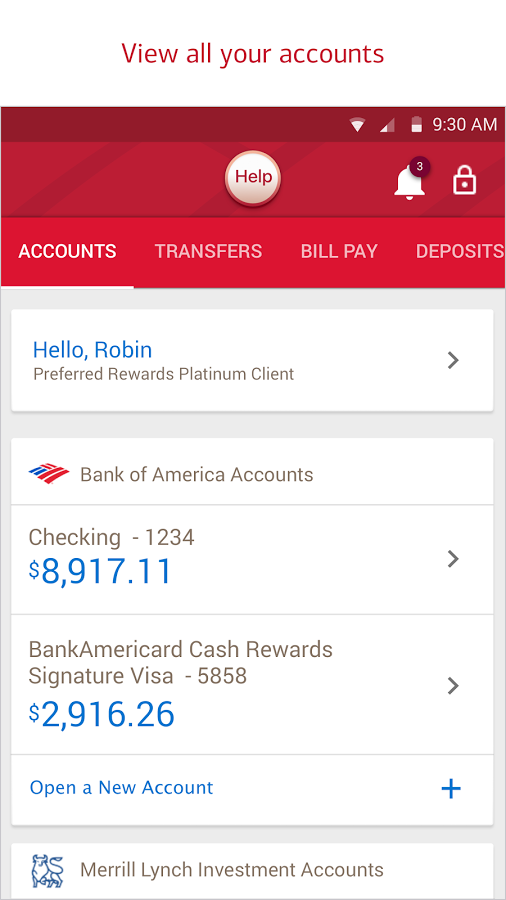

When I got back to Ghana in 2012, I was really surprised with the number of banks that were around. When I left in 2006, I remember GCB Bank. But now, there’s more than 6 banks, all competing for customers. Coming from the US, I was so used to my Bank Of America experience where I hardly ever went to the banking hall. I did all my transactions including transfer payments and checking my balance online and on their mobile app. The banking hall was useless to me unless I had to cash a cheque from somewhere.

However, the banking experience in Ghana was the opposite. You needed to go to the banking hall to do almost everything. Just seeing the queue of people lined up to make simple transactions like depositing/cashing a cheque and making money transfers to other accounts was depressing. And let’s not talk about the paperwork! To fill out a form just so I can deposit money in my own account is a travesty!

Are Banking Apps Ready To Go Mainstream?

It’s 2017 and it looks like many of the banks are starting to get the message: Customers want better experiences and more convenience. Many of the big banks have mobile apps now.

Just having an mobile online doesn’t mean you’re now into “mobile banking”. It’s the experience and features on your app that counts.

Currently, my bank app allows me to do the things that ExpressPay does: Buy Airtime, Do mobile money transfers, and pay for utilities. But I still use ExpressPay.

Why? Because it’s faster. My bank app takes a longer time to load and process requests. Like I said earlier in the post, buying airtime takes me less than a minute. Buying airtime via my bank app takes me a minute and some change.

But honestly, if my bank app gets faster and the experience is smoother, I might decide to simply use my bank app as default. Nothing wrong with using a third party payment app but if I pay for things straight from my account, why wouldn’t I?

I had a conversation with the head of Retail Banking and the head of Digital Banking at Standard Chartered Bank. They seem very keen on pushing for more online banking at their branches. They also have a mobile app which does things that ExpressPay does.

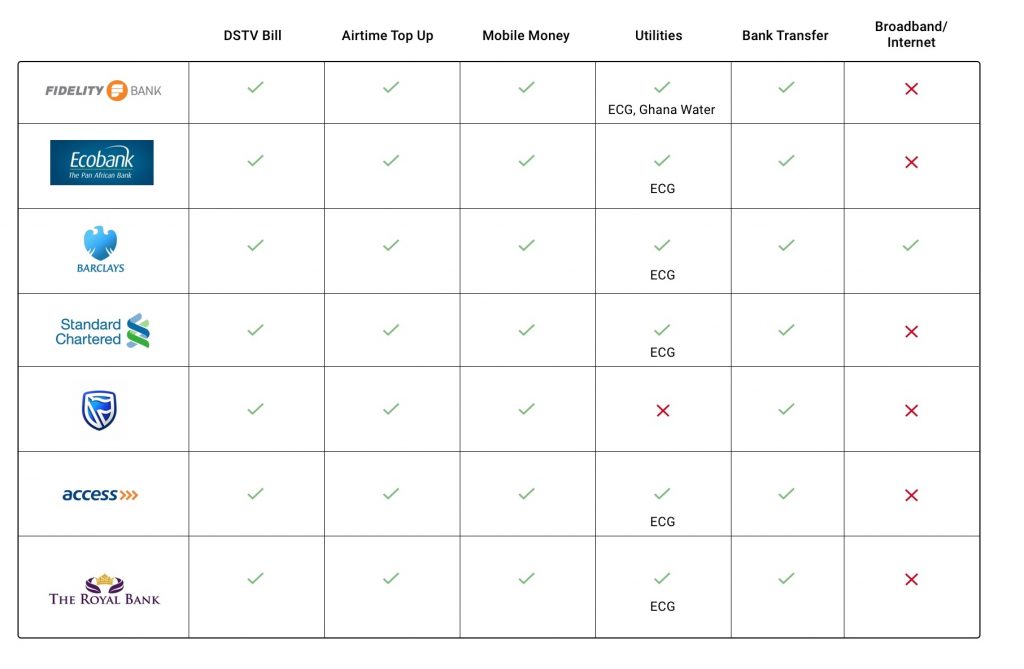

There are other bank which have mobile apps: Ecobank, Fidelity Bank,, Barclays and Access Bank all have mobile apps. But I hardly see the marketing and promotion for these apps. It’s like they’re almost afraid to show them off. Or maybe they’re not confident that the consumer is ready to adopt these apps.

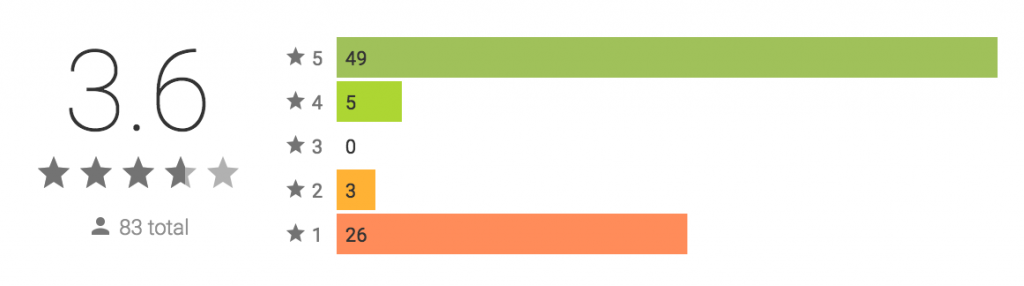

That could be the case. When you go to the mobile app stores and read the reviews of some of these apps, they’re not pretty.

Some of the highly rated reviews are actually pretty shady if you ask me. But sometimes, you just can’t fake your way to a good review.

Don’t let the amount of downloads for these mobile apps fool you. Just because a bank app has 50,000 downloads doesn’t mean that all these users constantly use the app.

Mobile Payment Apps Are Safe… For Now

Right now, I’m used to the ExpressPay app. I do a quick in and out to do transactions. But if I have to check my bank balance, I whip out my bank app and check. But at which app will I just decide to use my bank app for everything? I don’t know yet but if it gets better in the near future, I might decide to ditch the ExpressPay app altogether. But for the average Ghanaian who has a bank account but uses all the other payment apps, when they jump ship and use the apps their banks provide?

I think until banks get their stuff together, provide the best experience for their users on the app and actually go on a big marketing campaign, I think most people are still going to default with their mobile payment apps.

But that doesn’t mean that can’t change anytime soon. For now, I’ll keep purchasing mobile credit and doing other transactions on my ExpressPay app.

Update (04/12/2017): Updated the article to reflect that although GT Bank has a mobile app, it currently does not operate in Ghana.

*PS: Here’s a small table to show the various banks who have mobile apps and what features they have. If you want to help out, send in a comment to say what’s missing/what needs to removed/what needs to be added. Thanks!*